Global Distribution Systems (GDS) vs. New Distribution Capability (NDC): The Future of Travel Distribution

Introduction

The travel industry is constantly evolving, and so too are the ways in which travel is distributed. Two key players in this ever-changing landscape are Global Distribution Systems (GDS) and New Distribution Capability (NDC). In this comprehensive article, we will explore the key differences between GDS and NDC, their respective strengths and weaknesses, and the latest trends in travel distribution.

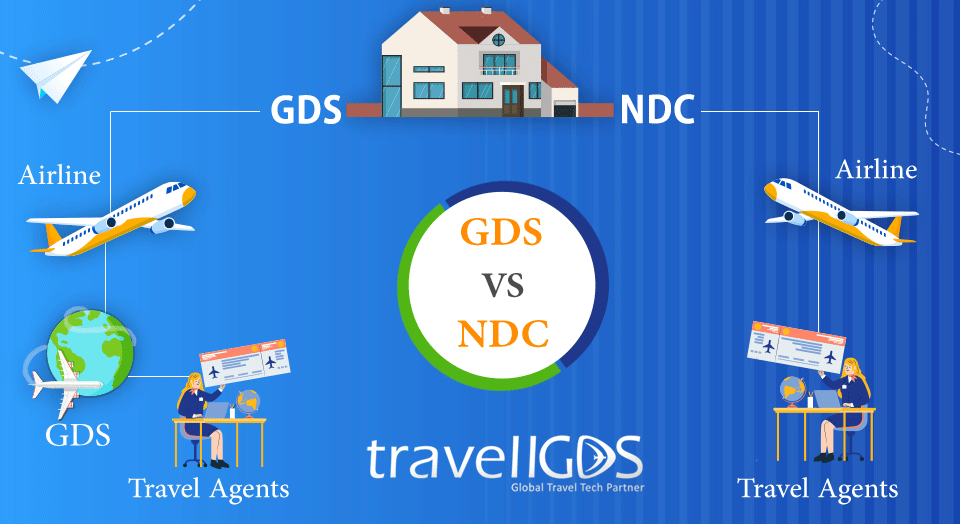

GDS facilitates traditional travel booking, while NDC transforms it, allowing airlines to connect directly with travelers for personalized experiences.

Global Distribution Systems (GDS)

GDS platforms have been the backbone of travel distribution for decades. These systems provide travel agents and companies with a centralized platform to access a vast inventory of airline, hotel, and other travel-related information. Key GDS players include Amadeus, Sabre, and Travelport.

Strengths of GDS:

- Vast inventory

- Reliability

- Global reach

- Support for complex bookings

- Established relationships

GDS platforms offer a wide range of travel content, making them a one-stop shop for travel agents and companies.

GDS systems are known for their reliability and ability to handle high transaction volumes.

GDS has a global presence, ensuring that travel agents worldwide can access a consistent set of travel data and services.

GDS systems are well-suited for managing complex itineraries and bookings, such as multi-airline journeys and multiple accommodation options.

GDS companies have long-standing relationships with airlines, hotels, and other travel suppliers, which contributes to smoother transaction experiences.

New Distribution Capability (NDC)

NDC is a relatively recent innovation in travel distribution. It is a set of standards and technologies that enables airlines to directly distribute their content to travelers and travel agencies, bypassing intermediaries such as GDS platforms.

Strengths of NDC:

- Personalization

- Direct connectivity

- Dynamic pricing

- Rich content

- Agility

NDC empowers airlines to offer tailored fares and ancillary products based on travelers’ unique preferences and behaviors.

Airlines can connect directly with travelers or travel agencies, which can potentially reduce distribution costs.

NDC facilitates real-time dynamic pricing, enabling airlines to quickly adapt to market demand, maximize revenue, and respond to competitive pressures.

NDC supports rich content such as images and videos, providing travelers with a more immersive and informative booking experience.

NDC enables airlines to quickly introduce and update their products and services, helping them to stay agile in a rapidly changing market.

The Battle for Supremacy: Tradition vs. Innovation

The rise of NDC has sparked a debate about the future of travel distribution. While GDS offers stability, expansive content, and a global footprint, NDC’s focus on personalization, dynamic pricing, and direct connectivity is reshaping how airlines interact with travelers.

The Latest Paradigm: A Blend of GDS and NDC

The answer to the question of which distribution model is the latest is perhaps unsurprisingly: It’s both. The travel industry is at a crossroads, where the coexistence of GDS and NDC is essential for meeting the diverse needs of modern travelers. The challenge now lies in harmonizing these systems to provide a seamless, traveler-centric booking experience.

Conclusion

GDS and NDC represent two different yet interrelated pillars of the travel industry. GDS has provided reliability and efficiency for decades, while NDC ushers in an era of personalization and dynamic pricing. The latest trend in travel distribution is not an either-or scenario; it’s about finding the right equilibrium between tradition and innovation.